There did not appear to be an extension of 179 to expire the end of this year which increased depreciation to $250,000 with certain requirements, which includes:

- You must have acquired qualified property by purchase after December 31, 2007, and before January 1, 2009. If a binding contract to acquire the property existed before January 1, 2008, the property does not qualify. *

- Qualified property must be placed in service after December 31, 2007, and before January 1, 2009 (before January 1, 2010, for certain transportation property and certain property with a long production period). *

- The original use of the property must begin with you after December 31, 2007.

The extension appeared in one of the US Senate version, but evidently was eliminated.

These two passed and were included in the “Bailout Bill:”

Sec. 305. Extension of 15-year straight-line cost recovery for qualified leasehold improvements and qualified restaurant improvements; 15-year straight-line cost recovery for certain improvements to retail space.

Sec. 505. Certain farming business machinery and equipment treated as 5-year property.

This may also qualify to aid the leasing industry:

Bailout bill gives tax break to Racetracks: A tax break for NASCAR racetracks and other motor-sports facilities is among the "sweeteners" tucked inside a 450-page financial-services bailout bill to make the package more palatable to lawmakers. The Senate-passed bill includes an array of so-called "tax extenders." One extends for two years a tax policy that had been allowed to expire in December that lets motor-sports facilities be treated the same as amusement parks and other entertainment complexes for tax purposes. That allowed them to write off their capital investments over a seven-year period. The motor sports industry feared that without a specific legal clarification, motor sports facilities would be required to depreciate their capital over 15 years or longer because of a recent Internal Revenue Service inquiry into the matter. That would make repaved tracks and new concession stands more expensive in the short term. It isn't a new tax break, rather the way tax law historically has been interpreted, said Lauri Wilks, the vice president of communications for Speedway Motorsports, which owns the NASCAR tracks in Fort Worth, Texas; Sonoma, Calif.; Concord, N.C.; and elsewhere. "It gives us incentive to go ahead and invest in our facilities," she said

A press release notes two additional advantages for leasing companies:

~*~PRESS RELEASE~*~

The Equipment Leasing and Finance Association (ELFA) applauds final congressional action on the EMERGENCY ECONOMIC STABILIZATION ACT OF 2008 (H.R. 1424). “We believe this critical legislation will help restore confidence in the capital markets and provide liquidity to the credit markets while providing adequate protection for U.S. taxpayers,” said Kenneth E. Bentsen, Jr., President of the Equipment Leasing and Finance Association.

“We appreciate the efforts undertaken by the Congress which should help to restore order and the flow of capital in the markets, while providing sufficient oversight and protections for the taxpayers,” said Bentsen.

ELFA also lauded several additional key measures in the bill including the extension of renewable tax credits for energy and a provision for active financial services income.

Renewable Energy: The extension of the renewable solar, wind and geothermal energy tax credits will enhance the ability of the equipment finance industry to spur development and investment in this high growth arena. ELFA has advocated for a multi year extension of the renewable energy production tax credits and the renewable energy investment tax credits as a crucial federal commitment to these clean energy technologies. These federal tax incentives go directly to developers and owners of renewable energy projects including financing parties in certain cases. The equipment attributes of solar projects are particularly suitable for leasing so the multi year extension should be a major boon to the equipment finance industry. This legislation extends the 30% investment tax credit (ITC) for commercial solar for eight years until December 31, 2016 and extends the placed in service date for the production tax credits (PTCs) for solar and geothermal through December 31, 2010 and wind through December 31, 2009. These credits were scheduled to expire on December 31, 2008.

Active Financing: The Equipment Leasing and Finance Association applauds congressional action extending for one year until December 31, 2009 the Subpart F provision for active financial services income. This rule addresses concerns about U.S. competitiveness and fairness by applying to our financial services companies the same general U.S. rule that defers current U.S. tax on other active trade or business income. Like their foreign-based competitors, our financial services firms –including manufacturers and leasing companies – will only pay a current tax in the country where their foreign operations are located.

~*~PRESS RELEASE~*~

Drudge Report on other bills added:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

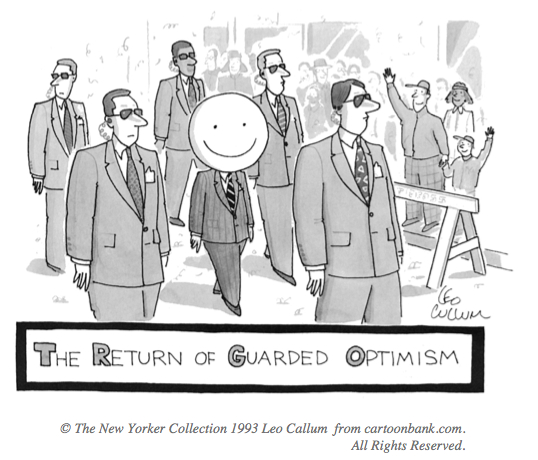

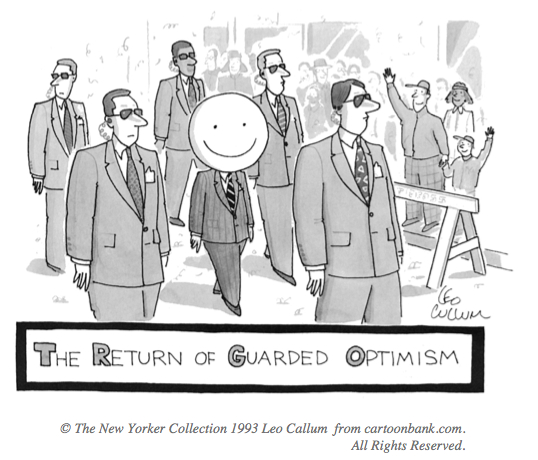

Looks like Uncle Sam likes leasing again! Combining this bail-out bill incentive with current market trends, all arrows point to lease financing as becoming the easiest method for acquiring funds!